With the introduction of the Minamata convention there is a need to understand the global changes in supply and demand for mercury. Current estimates suggest a downward trend in both supply and demand. The supply of mercury from primary mining has not decreased as much as initially expected. Indeed, mercury recovery from by-products of nonferrous production has not yet been implemented extensively. Currently Japan’s small amount of mercury is exported after being refined. In response to an expected decline in international demand, elemental mercury, which was traditionally traded as a valuable commodity, will need to be disposed of as waste.

In terms of projections the prevailing view is that there may be a global excess of approx. 24-25,000 tons by 2050. Recent projections reveal that trends in mercury recovery from the nonferrous smelting industry will have a significant impact on these estimates. China will have a major impact on these figures due to the country’s huge demand and supply for mercury. One projection has the cumulative excess in mercury in China at 10,000 tons in 2050.

Observers are having difficult estimating future mercury supply and demand as companies accelerate their acceptance of the Minamata Convention.

The mercury supply sector covers primary mining and recycled mercury recovered from manufacturing processes. This includes nonferrous metal production, natural gas refining, and vinyl chloride monomer (VCM) and mercury-added products. Forecaster, Reiko Sodeno, in his September 23 academic paper suggests that primary mercury mining will be half 2020 levels in 2025 with a complete phase out likely by 2032.

Mercury mining estimates

Under the Minamata Convention, new primary mercury mining has been prohibited since 2017. Mercury production from existing mines is allowed until 2032.

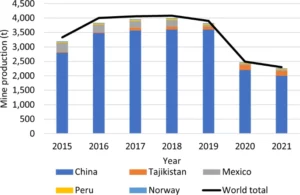

The chart above shows the trend of mercury mining in the world’s top five mercury-producing countries, and the world total. Although the Minamata Convention encourages a reduction of reliance on primary mercury, primary mercury mining was not restrained after 2015. In 2020 and 2021, there was finally a decline in global mercury production.

Not surprisingly, the global implementation of the Minamata Convention has resulted in a downward trend of both imports and exports. Mercury supply from primary mining did not decrease as much as expected, but a decrease has been observed in China, the largest producer, starting in 2020.

Studies suggest that there will be an unintentional increase in mercury unintentionally generated as a by-product of industrial processes. In the final disposal of elemental mercury, the EU and Japan have established disposal standards for permanent disposal. Challenges remain in providing final disposal sites, and the long-term stability of these treated mercury compounds will need to be verified further.

Where Ecocycle fits in

Ecocycle, with its service of the mining industry continues to monitor best practice throughout the world. It is mindful of the importance of collecting and recycling mercury compounds in a safe and efficient way. Ecocycle plan to have their mercury retirement equipment commissioned in late 2024 at the Kwinana Beach facility. The facility will convert elementary mercury into encapsulated inert waste.

Mercury in dental amalgam recovered from the drilling of old fillings is banned from going into sewers in most countries. Simple filtration systems can be used to collect this waste to protect the environment. For an investment of approx. $650 Ecocycle can solve the recycling and collection problem for dentists nationally. Currently the government is monitoring developments in other parts of the world as mandatory collection has been talked about by the industry as a best practice outcome.